What is FHA?

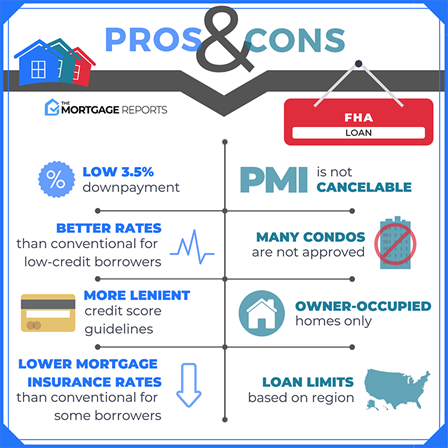

FHA stands for the Federal Housing Administration and the primary function of the FHA is to insure mortgages are issued by approved lenders, thereby reducing the risk for these lenders and enabling them to offer more favorable terms to borrowers who might not qualify for conventional loans.

FHA Features:

- Government Backing

- Low Down Payments

- Varied Loan Options

- Flexible Credit Requirements

- Assumable Mortgages

What FHA is Available For:

FHA loans are available for various purposes, including:

- Home Purchase: FHA loans can be used to purchase a primary residence, including single-family homes, condominiums, townhouses, and multi-unit properties (up to four units).

- Refinancing: Borrowers with existing FHA loans may be eligible for FHA streamline refinancing, which allows them to refinance their mortgage with minimal documentation and lower costs.

- Renovation: The FHA program enables borrowers to finance the purchase or refinance of a property along with the cost of renovations or repairs, making it an attractive option for buyers looking to invest in fixer-upper properties.

Who FHA is Available To:

FHA loans are available to a wide range of borrowers, including:

- First-Time Homebuyers

- Low-to-Moderate Income Borrowers

- Borrowers with Limited Credit History

- Borrowers with Low Credit Score